How To Make Money Today: Daily Gold (XAUUSD) Market Analysis and Forex Trading Signals 6 April 2022

To assist you to make a good day-trading selection, we’ll cover the newest forex market analysis. Make more money today with our market analysis. You must know how to trade first, and have at least a simple understanding of chart patterns. Aside from that, we’ll cover some basic tips and methods that can aid anybody curious in day trading strategies. So let’s start by looking at some charts from today…

Looking for perfect daily analysis and/or a managed investment account with the world's biggest brokers and make stable 30% - 50% Return on Investment weekly?

Looking for perfect daily analysis and/or a managed investment account with the world's biggest brokers and make stable 30% - 50% Return on Investment weekly?![]()

Text us now on WhatsApp for more information! We are online waiting for you!

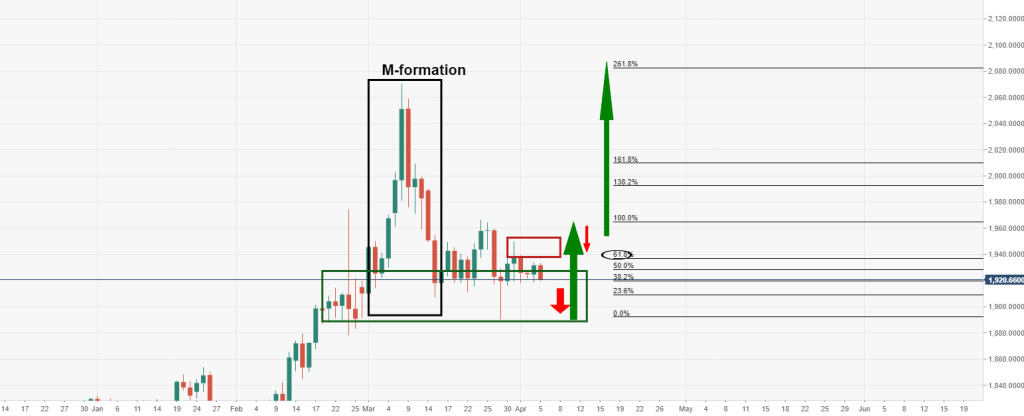

XAU/USD (GOLD):

On the H1, prices are consolidating sideways. We see the potential for a bounce from our 1st support at 1915.994 which is in line with 78.6% Fibonacci projection towards our 1st resistance at 1937.627 in line which is a graphical overlap and in line with 78.6% Fibonacci Projection. RSI is on bullish momentum, further supporting our bullish bias.

Areas of consideration:

- 4h 1st support at 1915.994

- 4h 1st resistance at 1937.627

Gold price forecast: XAU/USD is expected to drop to about $1,900 as hawkish Fed officials dampen market sentiment.

- Gold is stuck in a tight range, waiting for a spark.

- The US currency is being boosted by Fed rhetoric, while gold is being weighed down.

- XAU/USD is expected to continue negative in the face of increasing US rates.

Update:

After a massive sell-off on Tuesday, gold (XAU/USD) is struggling in the Asian session. Given the adverse market movement and aggressive tone espoused by Federal Reserve (Fed) officials, the precious metal is anticipated to drop to around the psychological support of $1,900.00. In a speech on Tuesday, Fed Governor Lael Brainard said that the Fed is prepared to move aggressively if inflation data and expectations indicate that such action is warranted. While Fed President Mary Daly has emphasized the need for the Fed to reduce its balance sheet as soon as possible. Furthermore, increased oil costs will not cause a significant downturn in the US economy.

On the other hand, on negative market mood, the US dollar index (DXY) has risen to almost 99.60. Fed members’ hawkish positions suggest that, in the future, rising interest rates will limit liquidity influx throughout the globe. The risk-off impulse has been triggered, and the greenback is now climbing higher. Aside from the DXY, increased prospects of a 50 basis point (bps) interest rate rise have injected steroids into US Treasury rates. The 10-year US Treasury rates have surpassed 2.6 percent and are on the verge of setting a new three-year high.

End of update.

The price of gold fell somewhat as the US currency gained strength. The DXY index, which measures the value of the dollar against a basket of other currencies, reached its highest level in over two years. The benchmark 10-year Treasury yield has risen to 2.55 percent, while the two-year yield has risen to 2.56 percent for the first time since March 2019.

Spot gold fell 0.3 percent to $1,916 per ounce, but was trading in a tight range, while US gold futures down 0.1 percent to $1,931.20. XAU/USD is down 0.2 percent at $1,921 at the time of writing, pressured in Asia after remarks by Federal Reserve Governor Lael Brainard.

In advance of tomorrow’s hawkish minutes, the Fed member mentioned the possibility of forceful action by the central bank. Brainard said that the Fed might begin lowering its balance sheet as early as May, and that it would do so at a “rapid pace.” Interest rate rises might be more aggressive than the usual 0.25 percentage point increments, according to Brainard.

Eyes on the Fed

Meanwhile, during the March meeting, Fed policymakers started the process of policy normalization by raising rates 25 basis points to 0.25 percent -0.50 percent, and the minutes of that meeting will be issued on Wednesday.

“In its policy advice, the FOMC pulls no punches, with Chair Powell implying that further information on QT plans would be released in the minutes” (possibly including caps details). TD Securities analysts stated, “We continue to anticipate a formal QT announcement at the May FOMC meeting.”

“Gold prices have remained remarkably robust, indicating strong ETF and comex inflows into gold trumping withdrawals linked with a hawkish Fed,” according to TD Securities analysts.

“Because actual rates may be less effective as a barometer for evaluating gold’s relative price, we look at gold flows to see how long interest in the yellow metal will last.” ETF flows have tended to be more significantly connected with changes in market expectations for Fed hikes than actual rates, the yield curve, or even price momentum, according to our study.

This still shows that the large ETF inflows were driven by safe-haven demand, which might lead to negative risks if negotiations continue to work toward a ceasefire and trade subsidies become a concern.”

Gold, technical analysis

The M-formation is a bullish reversion pattern, thus the price should be drawn to the neckline between $1,980 and $2,000. However, the sideways consolidation has played out to the point that gold is presently being opposed by a 61.8 percent Fibo, indicating a bias to the downside for the short term.

[geoswitch_country]'s wealthiest traders share their secret trading strategy in the Extreme FX Wealth eBook. Register now and download!

[geoswitch_country]'s wealthiest traders share their secret trading strategy in the Extreme FX Wealth eBook. Register now and download!

0.0 pips spreads | 500:1 leverage

Daily Super Signals (Hit Take Profit targets: TP1 is 100% accurate, TP2 is 100% accurate, TP3 is 85% accurate)

[maxbutton id="18" url="https://tinyurl.com/bigroifx" text="Open Demo Account" ] [maxbutton id="17" url="https://tinyurl.com/bigroifx" text="Open Live Account" ]

This is how you can make €1000 income daily!

FOR DAILY SIGNALS, TECHNICAL VIEWS, MANAGED ACCOUNTS and other services with GUARANTEED PERFORMACE, simply text us on WhatsApp to get more info!

Click here to send a dircet text to us!

WhatsApp number: +447747535495

Daily Super Signals (Hit Take Profit targets: TP1 is 100% accurate, TP2 is 100% accurate, TP3 is 85% accurate)

[maxbutton id="18" ] [maxbutton id="17" ]

and gain access to the Premium Daily Signals, made by certified CFA traders with guaranteed minimum profit of 50 pips per trade (5 - 10 premium signals daily)

MAKE MORE MONEY

ENJOY YOUR LIFE! LEAVE THE TRADING TO US!

Text us for more info about our managed trading accounts!