EUR/USD soared to fresh highs in 2024, reaching 1.1050 as the US Dollar remained weak post-US CPI data. With the release of US Retail Sales on the horizon, investors are closely watching the currency pair’s movements.

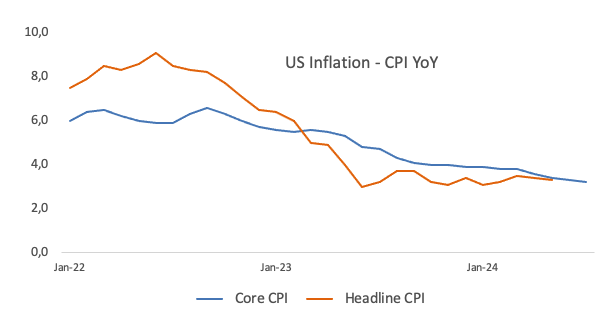

After the latest US inflation figures showed a downward trend in July, expectations for a half-point rate cut by the Federal Reserve in September have decreased. The FedWatch Tool now predicts a 65% probability of a 25 bps rate cut.

While the ECB has stayed quiet, Fed policymakers are expected to share their views as the September meeting approaches. The divergence in monetary policies between the Fed and ECB could narrow if the Fed opts for more rate cuts, potentially supporting a rebound in EUR/USD.

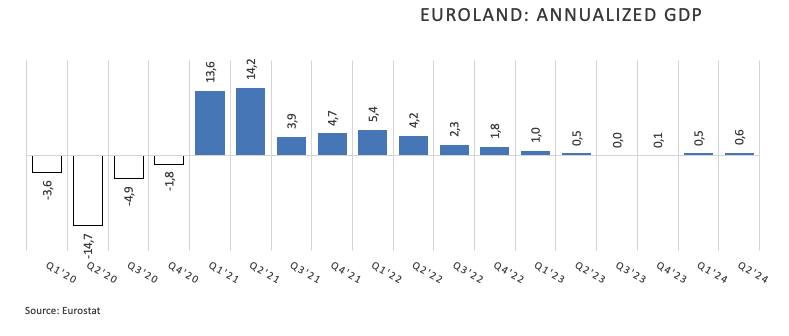

However, in the long term, the US economy is expected to outperform Europe, suggesting that any weakness in the Dollar may be short-lived. The upcoming US Retail Sales data and recent euro area GDP and Industrial Production numbers will provide further insights into the economic health of both regions.

EUR/USD Technical Outlook

EUR/USD is set to challenge its 2024 high of 1.1047, with potential resistance at 1.1139. On the downside, support levels include the 200-day SMA at 1.0837, the weekly low of 1.0777, and the June low of 1.0666.

Looking at the larger picture, the pair’s upward trend is expected to continue as long as it remains above the 200-day SMA. The four-hour chart shows a strong positive bias, with resistance levels at 1.1047 and 1.1132, and support levels at 1.0881, 1.0864, and 1.0777.

Overall, the future movements of EUR/USD will be influenced by economic data releases and central bank policies, with potential implications for investors and traders in the forex market.