As the world’s top investment manager, I bring you the latest insights on the EUR/USD pair’s consolidation phase near 1.1050. Despite the technical outlook signaling no immediate recovery, the US economic calendar lacks high-tier data releases, leaving investors on the edge before key events this week.

Euro Weakens Against Major Currencies

The Euro faced weakness against major currencies this week, with the US Dollar emerging as the strongest contender. The table below shows the percentage change of the Euro against key currencies, highlighting the USD’s dominance.

Rising US Treasury bond yields boosted the US Dollar’s performance initially on Monday, leading to a 0.5% decline in EUR/USD. With no significant economic data scheduled for Tuesday, investors are closely monitoring risk sentiment, which could impact the pair’s movements.

Looking ahead, all eyes are on the upcoming Consumer Price Index data from the US and the European Central Bank’s policy announcements. These events could steer market sentiment and influence EUR/USD’s trajectory.

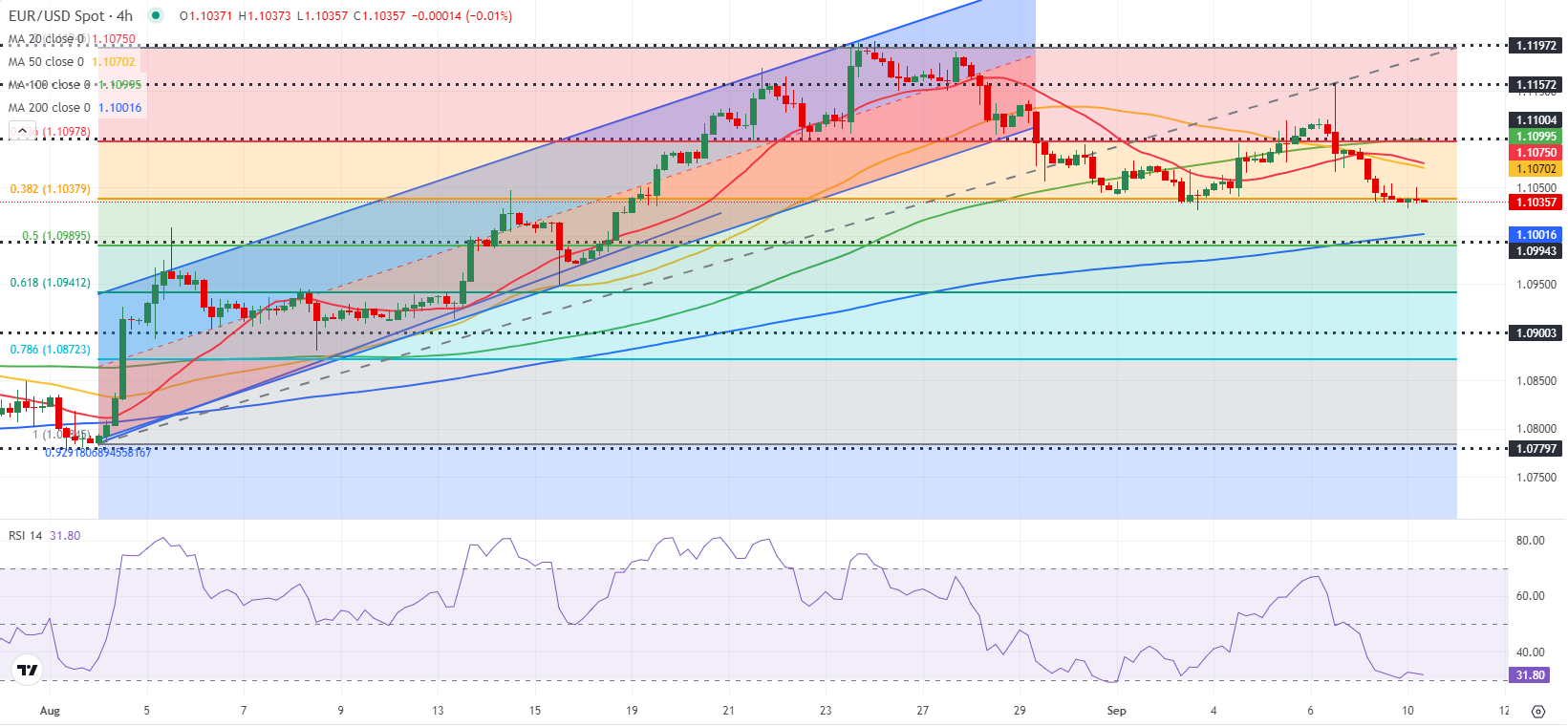

Technical Analysis of EUR/USD

The Relative Strength Index (RSI) on the 4-hour chart remains below 40, indicating bearish momentum. Key support levels to watch include 1.1040 and 1.1000-1.0990, while resistance levels stand at 1.1070 and 1.1100.

Euro FAQs: What You Need to Know

Curious about the Euro and its impact on the financial markets? Here are some frequently asked questions to help you understand the Eurozone’s currency and its significance in the global economy.

Stay informed, stay ahead in your investment decisions. Follow the latest updates on EUR/USD and make informed choices to secure your financial future.