Why understanding forex patterns is important

Understanding forex patterns is crucial for any trader looking to succeed in the forex market. Patterns represent repetitive market behavior that can be analyzed and used to make informed trading decisions. By recognizing these patterns, traders can anticipate potential price movements and adjust their strategies accordingly.

Forex patterns provide valuable insights into market sentiment and can help identify trends and reversals. They reflect the collective actions of market participants and can signal areas of support and resistance. By understanding these patterns, traders can gain an edge and improve their profitability.

Common forex patterns to look out for

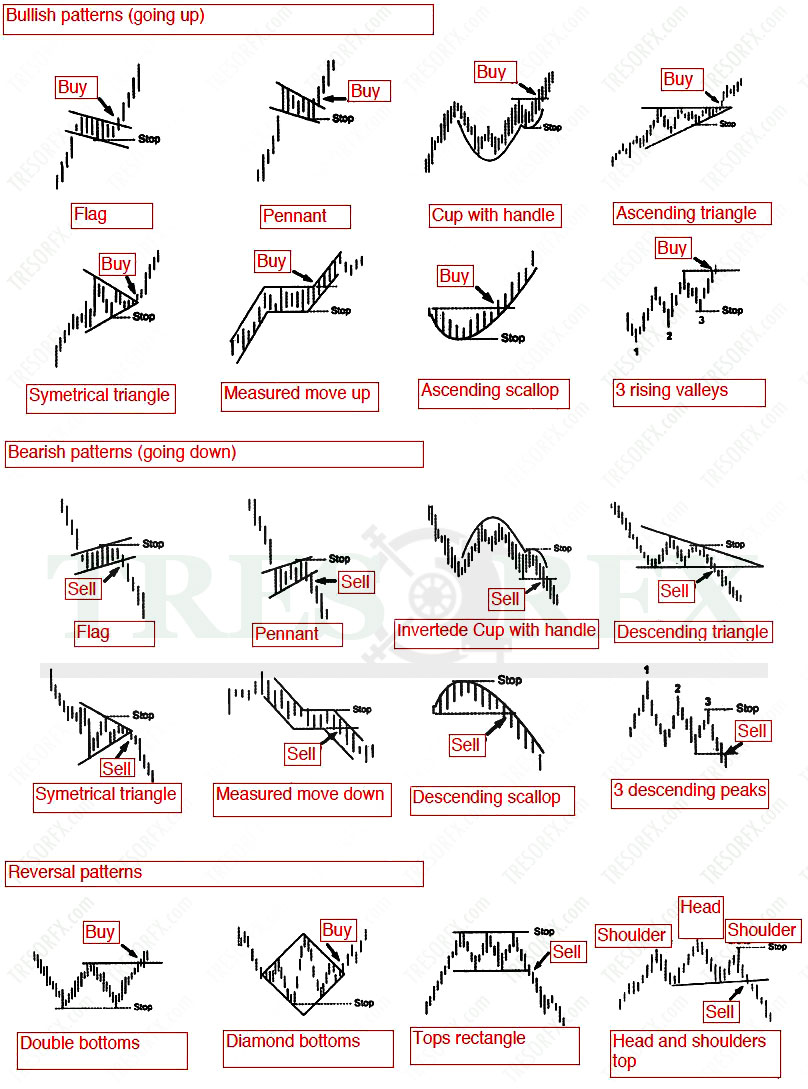

There are various forex patterns that traders should be aware of. These patterns can be categorized into bullish reversal patterns, bearish reversal patterns, and continuation patterns. Each pattern has its own characteristics and implications, and understanding them is essential for successful trading.

Bullish reversal patterns

Bullish reversal patterns indicate a potential change in the direction of a downtrend and signal a possible upward move in prices. These patterns often occur at the end of a downtrend and can provide traders with an opportunity to enter long positions.

One common bullish reversal pattern is the “double bottom.” This pattern forms when prices decline to a certain level, bounce back, and then decline again to a similar level before reversing higher. Traders look for a break above the neckline of the pattern to confirm the bullish reversal.

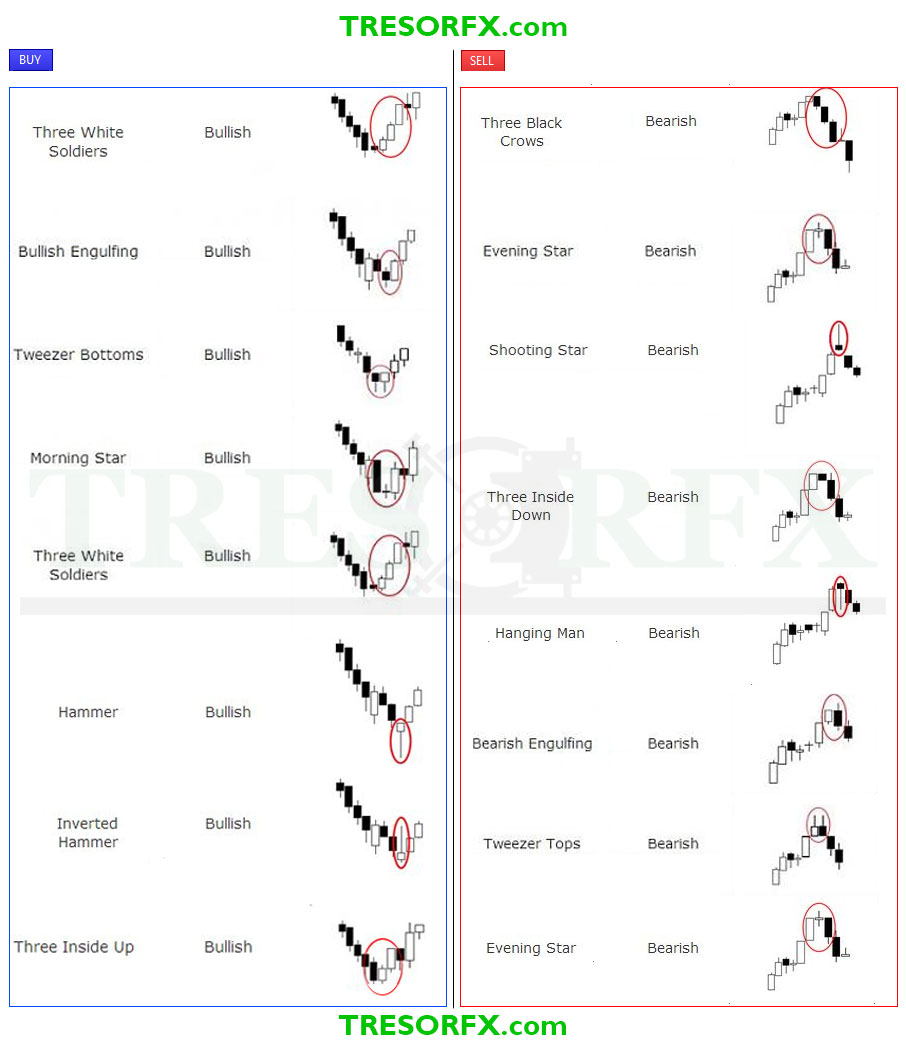

Another bullish reversal pattern is the “bullish engulfing” pattern. This pattern occurs when a small bearish candle is followed by a larger bullish candle that completely engulfs the previous candle. It suggests a shift in market sentiment from bearish to bullish.

Bearish reversal patterns

Bearish reversal patterns indicate a potential change in the direction of an uptrend and signal a possible downward move in prices. These patterns often occur at the end of an uptrend and can provide traders with an opportunity to enter short positions.

One common bearish reversal pattern is the “double top.” This pattern forms when prices rise to a certain level, retrace, and then rise again to a similar level before reversing lower. Traders look for a break below the neckline of the pattern to confirm the bearish reversal.

Another bearish reversal pattern is the “bearish engulfing” pattern. This pattern occurs when a small bullish candle is followed by a larger bearish candle that completely engulfs the previous candle. It suggests a shift in market sentiment from bullish to bearish.

Continuation patterns

Continuation patterns indicate a temporary pause in the prevailing trend before it resumes. These patterns suggest that the market is taking a breather before continuing in the same direction. Traders can use continuation patterns to identify potential entry points in the direction of the trend.

One common continuation pattern is the “flag” pattern. This pattern forms when prices move in a tight range after a sharp price move. It resembles a flag on a pole and suggests that the market is consolidating before resuming the previous trend.

Another continuation pattern is the “triangle” pattern. This pattern forms when prices consolidate within a converging range, forming higher lows and lower highs. Traders look for a breakout from the triangle pattern to confirm the continuation of the trend.

Incorporating forex patterns into your trading strategy can significantly improve your success rate. By combining pattern recognition with other technical indicators and risk management techniques, traders can increase their profitability and reduce their risk exposure.

When using forex patterns, it’s important to wait for confirmation signals before entering trades. Confirmation signals can include a break of a trendline or a specific price level, the convergence of multiple indicators, or the occurrence of a specific candlestick pattern.

Additionally, traders should always consider the broader market context when analyzing forex patterns. Factors such as economic data, geopolitical events, and market sentiment can influence the validity and effectiveness of patterns. It’s essential to stay informed and adapt your strategy accordingly.

Identifying and trading forex patterns requires practice and experience. Here are some tips to help you improve your pattern recognition skills and optimize your trading strategy:

1. Study and analyze historical price data to familiarize yourself with different patterns and their characteristics. Look for recurring patterns and observe how they unfold in different market conditions.

2. Use charting software and tools to simplify pattern identification. Many trading platforms offer built-in pattern recognition tools that can quickly scan multiple charts and alert you to potential patterns.

3. Combine pattern analysis with other technical indicators, such as moving averages, oscillators, and volume indicators, to confirm signals and increase the accuracy of your trades.

4. Keep a trading journal to record your observations and track the performance of your pattern-based trades. Review your journal regularly to identify patterns that work well for you and areas for improvement.

5. Practice risk management and set realistic profit targets and stop-loss levels for each trade. Never risk more than you can afford to lose, and always maintain a disciplined approach to trading.

Continuation patterns

As with any skill, continuous learning is essential for mastering forex patterns. Here are some resources that can help you deepen your understanding and enhance your trading skills:

1. Books: There are many books available that cover various aspects of technical analysis and forex pattern recognition. Some popular titles include “Japanese Candlestick Charting Techniques” by Steve Nison and “Technical Analysis of the Financial Markets” by John J. Murphy.

2. Online courses: Numerous online platforms offer courses on technical analysis and forex trading. These courses provide structured learning and can help you develop a solid foundation in pattern recognition and analysis.

3. Webinars and seminars: Attend webinars and seminars conducted by experienced traders and industry experts. These events often provide valuable insights and practical tips for identifying and trading forex patterns.

4. Trading forums and communities: Engage with other traders in online forums and communities. Share your experiences, ask questions, and learn from the collective knowledge of the trading community.

Remember, mastery of forex patterns takes time and practice. Stay committed to your learning journey, and with persistence, you’ll develop the skills and confidence to navigate the forex market successfully.

Using forex patterns in your trading strategy

Forex patterns are a powerful tool for traders looking to gain an edge in the market. By understanding and effectively utilizing these patterns, you can improve your trading decisions and increase your profitability.

Our ultimate cheat sheet provides a comprehensive reference for the most commonly occurring forex patterns. With clear explanations and visual examples, it’s an invaluable resource for traders of all levels. Take advantage of this cheat sheet, combine it with your existing knowledge and experience, and unlock the potential for consistent profits in the forex market.

Don’t let forex patterns intimidate you. With our cheat sheet as your guide, you can navigate the complexities of the market with confidence and take control of your trading journey. Start mastering forex patterns today and elevate your trading skills to new heights.

Tips for identifying and trading forex patterns

Forex patterns are essential tools for traders to analyze and predict market movements. These patterns are formed by the price action of various currency pairs, and they can provide valuable insights into future price movements. By understanding and using forex patterns, you can make more informed trading decisions and improve your chances of success in the market.

Recognizing Chart Patterns

Chart patterns are one of the most widely used and reliable forex patterns. These patterns are formed by the price movements on a forex chart and can indicate potential trend reversals or continuations. Some of the most commonly used chart patterns include:

1. Head and Shoulders Pattern

The head and shoulders pattern is a reversal pattern that signals the end of an uptrend. It consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). Traders often look for a break below the neckline of this pattern to confirm a bearish trend reversal.

2. Double Top and Double Bottom

The double top pattern is formed when the price reaches a high point twice and fails to break above it. This pattern indicates a potential trend reversal from bullish to bearish. On the other hand, the double bottom pattern is the opposite, signaling a potential trend reversal from bearish to bullish.

3. Triangle Pattern

The triangle pattern is a continuation pattern that shows a period of consolidation in the market. It is formed by connecting the highs and lows of the price action with trendlines. Traders often look for a breakout above or below the triangle to confirm the direction of the trend.

Understanding and recognizing these chart patterns can give you a significant edge in your trading strategy. By studying historical price movements and identifying these patterns, you can anticipate potential market movements and make better trading decisions.

Analyzing Candlestick Formations

Candlestick formations are another powerful tool for analyzing forex patterns. These formations are created by the open, high, low, and close prices of a specific time period. By studying the shapes and patterns formed by these candlesticks, you can gain insights into market sentiment and potential price reversals.

1. Doji Candlestick

A doji candlestick is characterized by its open and close prices being very close or equal. This formation indicates indecision in the market and can signal a potential trend reversal. Traders often look for confirmation from other technical indicators or candlestick patterns before making trading decisions based on a doji.

2. Hammer and Shooting Star

The hammer and shooting star candlestick patterns are reversal patterns that signify potential trend reversals. The hammer is formed by a long lower shadow and a small body, indicating a bullish reversal. On the other hand, the shooting star has a long upper shadow and a small body, indicating a bearish reversal.

3. Engulfing Candlestick

The engulfing candlestick pattern occurs when a larger candle completely engulfs the previous smaller candle. This formation signals a potential trend reversal and is often used by traders to confirm other technical indicators or patterns.

By understanding and analyzing these candlestick formations, you can gain valuable insights into market sentiment and potential price movements. Incorporating candlestick analysis into your trading strategy can enhance your decision-making process and improve your overall trading performance.

Resources for learning more about forex patterns

Identifying and trading forex patterns can be a challenging task, especially for beginners. However, with the right knowledge and approach, you can become proficient in recognizing these patterns and incorporating them into your trading strategy. Here are some tips to help you get started:

1. Study and Practice

Forex patterns require a solid understanding of technical analysis and chart reading. Take the time to study different patterns and their interpretations. Additionally, practice identifying patterns on historical charts and in real-time trading situations. The more you practice, the better you will become at recognizing patterns and making accurate trading decisions.

2. Use Multiple Time Frames

Forex patterns can appear on different time frames, ranging from minutes to months. By analyzing patterns on multiple time frames, you can gain a more comprehensive view of the market and identify high-probability trading opportunities. For example, a pattern that appears on both the daily and weekly charts is typically considered more reliable than one that appears on just the hourly chart.

3. Combine Patterns with Other Indicators

Forex patterns are most effective when used in conjunction with other technical indicators. For example, you can combine a bullish chart pattern with a bullish divergence on the Relative Strength Index (RSI) for a stronger confirmation of a potential trend reversal. Experiment with different combinations of indicators and patterns to find what works best for your trading style.

4. Practice Risk Management

While forex patterns can provide valuable insights into potential market movements, they are not foolproof. It’s important to always practice proper risk management and set stop-loss orders to limit potential losses. Additionally, avoid overtrading or becoming overly reliant on patterns alone. Use them as a tool to enhance your decision-making process, but always consider other factors such as market fundamentals and news events.

Conclusion: Harness the power of forex patterns for success in the market

The world of forex patterns is vast and constantly evolving. Fortunately, there are plenty of resources available to help you expand your knowledge and improve your trading skills. Here are some recommended resources to consider:

1. Forex Trading Courses

Many reputable online platforms offer comprehensive forex trading courses that cover various aspects of technical analysis, including forex patterns. These courses often provide in-depth explanations, real-life examples, and practical exercises to help you master the art of pattern recognition.

2. Trading Books

There are numerous trading books available that delve into the intricacies of forex patterns and technical analysis. Some popular titles include “Japanese Candlestick Charting Techniques” by Steve Nison and “Technical Analysis of the Financial Markets” by John J. Murphy. These books provide valuable insights and can serve as a reference for both beginner and advanced traders.

3. Online Forums and Communities

Engaging with like-minded traders on online forums and communities can be an excellent way to learn from others’ experiences and gain new perspectives on forex patterns. Platforms such as Forex Factory and Reddit have dedicated sections where traders discuss various patterns, share insights, and answer questions.

4. Webinars and Seminars

Many forex brokers and trading educators offer webinars and seminars on technical analysis and forex patterns. These events often feature industry experts who share their knowledge and provide practical tips for incorporating patterns into your trading strategy. Attending these events can be a valuable learning opportunity and a chance to network with other traders.

Remember, learning about forex patterns is a continuous process. Stay curious, keep learning, and always be open to new ideas and strategies. The more you invest in your education, the better equipped you’ll be to navigate the forex market and achieve consistent profitability.